what is tax lot meaning

Information and translations of tax lot in the most comprehensive dictionary definitions resource on the web. Choose the time period and either Realized or Unrealized gain and loss.

:max_bytes(150000):strip_icc()/GettyImages-914675658-ef28de13799f4a8582e3c46be4e1668a.jpg)

How To Use Tax Lots To Pay Less Tax

Go to your Accounts page.

. What does tax lot mean. Lot Relief Method. By comparing the sale price to the cost basis you and the IRS make an accurate determination on the profits.

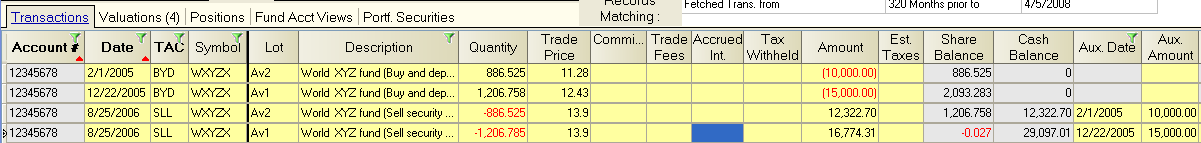

A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing prices. The tax lot will detail the terms of each transaction that involves each security in the. Meaning of tax lot.

This recordkeeping method allows an investor to. Tax lot accounting is important because it helps investors minimize their capital gains taxes. This page is about the various possible meanings of the acronym abbreviation shorthand or slang term.

Each acquisition of a security on a different date or for a different price constitutes a new tax. It records the cost purchase date sale price and sale date for each security held in a portfolio. Tax Lot means a parcel lot or other unit.

This page is about the various possible meanings of the acronym abbreviation shorthand or slang term. In the menu located next to the account select Tax Information. What do tax lots mean.

What does tax lot mean. Tax lots are documents that relate to any and all transactions that have to do with the investment portfolio. Tax Lot Accounting Definition est un terme anglais couramment utilisé dans les domaines de.

Each tax lot therefore will have a different cost basis. A tax lot is a record of the details of an acquisition of a security. The tax lots are multiple purchases made on different dates at differing prices.

Tax Lot Accounting Definition signifie Définition de la comptabilité du lot dimpôt. Finally the tax lot includes the sale price of the securities in the lot. A tax lot is a.

A method of computing the cost basis of an asset that is sold in a taxable transaction. What S The Difference Between Quarterly Taxes Vs Annual Taxes Quarterly Taxes Tax Payment Tax Integrity. Tax Lot means securities or other property which are both purchased or acquired and sold or otherwise disposed of as a unit.

To edit your tax lot. A method of accounting for a portfolio in which one keeps a record of the purchase price and sale price of each security in the portfolio along with each ones cost basis. What is tax lot meaning Tuesday March 15 2022 Edit.

Tax lot accounting is the record of tax lots. Tax-lot as a noun means accounting taxation US A grouping of security holdings in an account used for enabling the calculation and treatment. In our example above we sold 20 shares of Company XYZ for 10 per share.

What Is A Tax Lot. There are five major lot relief methods that can be used for this purpose. What does TAX LOT mean.

Understanding Your Tax Forms The W 2

Amazon Com Deduct Everything Save Money With Hundreds Of Legal Tax Breaks Credits Write Offs And Loopholes 9781630060473 Rosenberg Ea Eva Books

Off Shore Tax Havens Mean Fewer Teachers In Oregon Classrooms Our Oregon

Tax Lots Manage Your Account Frequently Asked Questions Help Center

Save On Taxes Know Your Cost Basis Charles Schwab

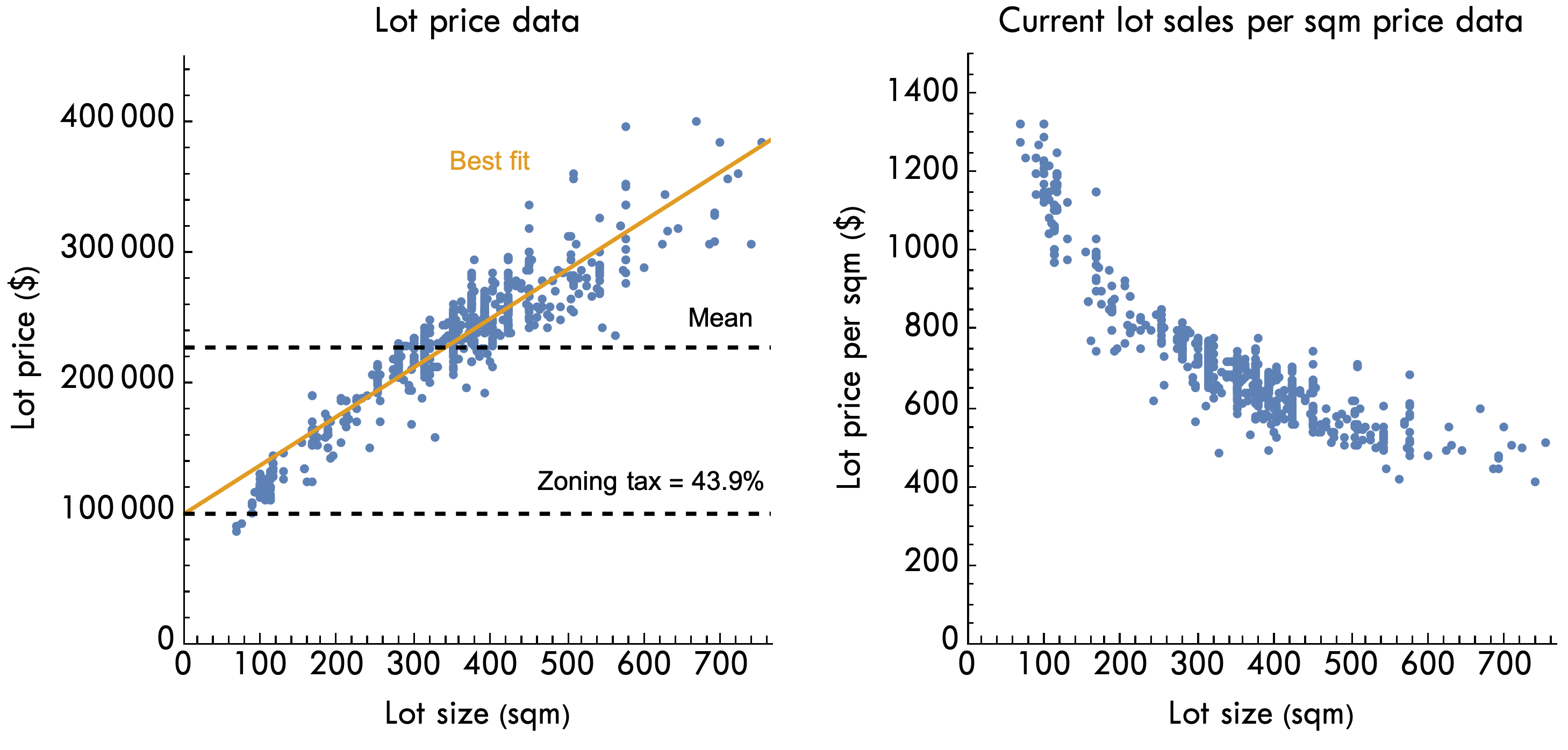

The Zoning Tax Is An Illusion By Cameron Murray

What Does The Recent Tax Deferral Mean For Arkansans Thv11 Com

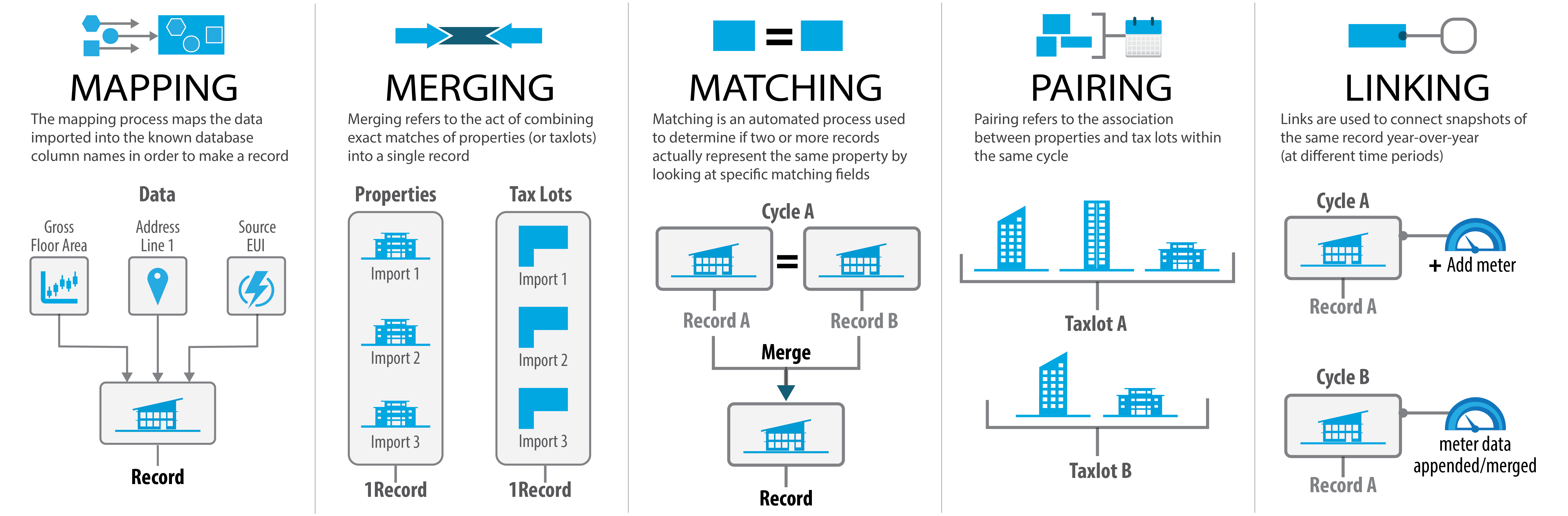

Inventory Management Seed Platform Documentation

How Do State And Local Property Taxes Work Tax Policy Center

What Are Tax Lots And How Do They Affect Your Capital Gains

Understanding Crypto Taxes Coinbase

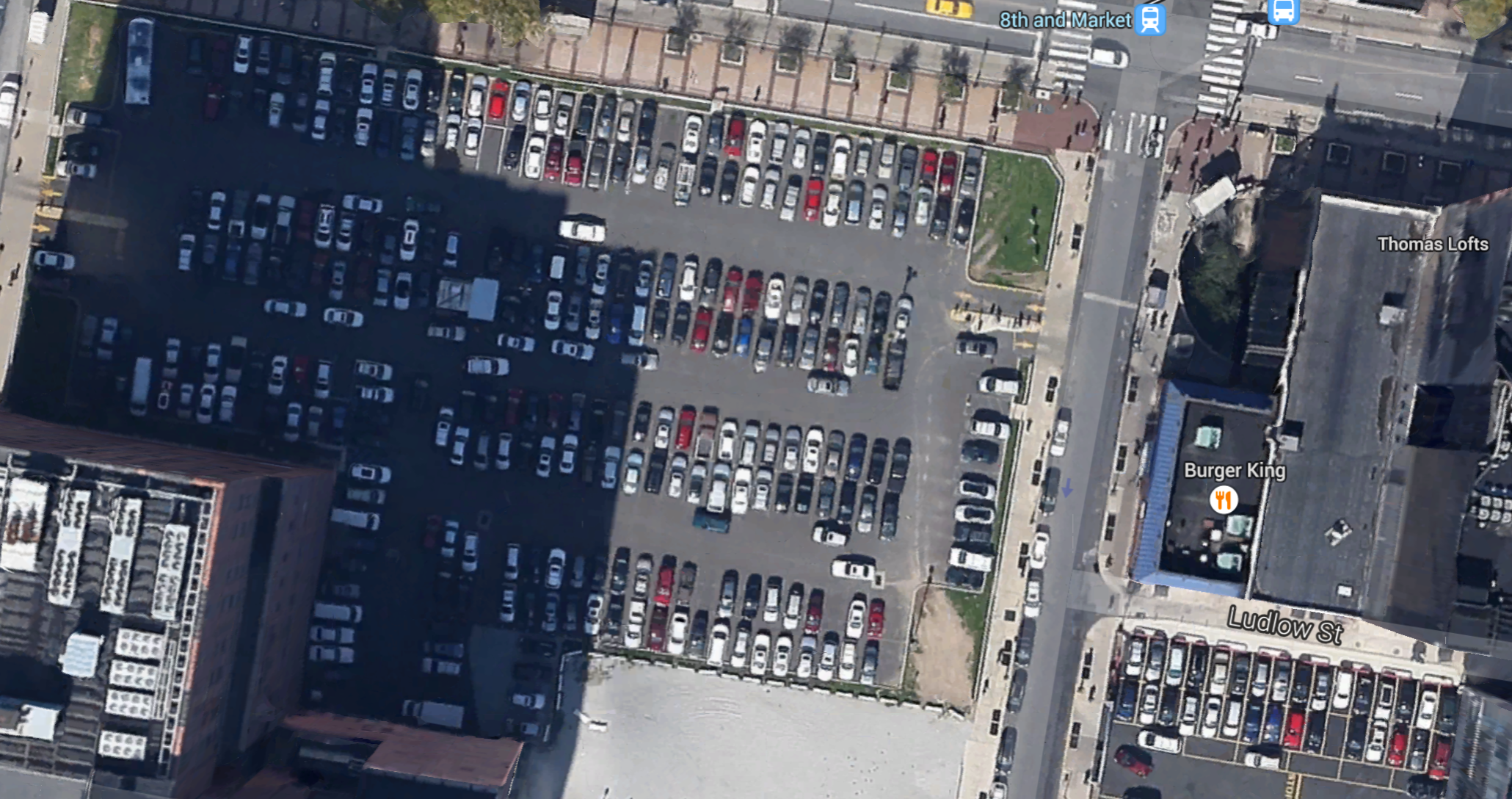

City Council Is Proposing A Parking Tax Increase What Would That Mean For Urban Development Whyy

Par21 0002 601 S Blaine Street Partition Newberg Oregon

Tax Loss Harvesting Capital Loss Deduction Td Ameritrade

What Are Tax Lots And How Do They Affect Your Capital Gains

Tax Lot Optimization Why It Matters To Investors Level Financial Advisors